Understanding Pocket Option License: Everything You Need to Know

Pocket Option has gained immense popularity in the world of online trading due to its user-friendly interface and a wide range of trading options. However, one of the most important aspects that traders often overlook is the broker’s licensing and regulation. Understanding the licensing of Pocket Option is crucial for ensuring a safe and secure trading experience. To gain insights into the regulatory environment of Pocket Option, you can refer to this resource: License Pocket Option https://pocket-option.plus/regulations-licenses/. In this article, we will delve into the details of Pocket Option’s licensing, what it means for traders, and the importance of engaging with regulated brokers.

What is Pocket Option?

Pocket Option is an online trading platform that allows traders to engage in a diverse range of financial instruments, including forex, cryptocurrencies, stocks, and commodities. It was established in 2017 and has become known for its innovative trading platform and various features aimed at both novice and experienced traders. With its impressive array of tools, including social trading, copy trading, and various analytical tools, Pocket Option has carved a niche for itself in the competitive online trading market.

The Importance of Licensing in Trading

The financial trading industry is highly regulated due to the risks involved and the potential for fraud. Licensing is a critical aspect that ensures a broker operates under the oversight of regulatory authorities, which helps protect traders’ interests. Here are a few key reasons why licensing matters:

- Investor Protection: Licensed brokers are required to adhere to strict guidelines designed to protect traders from unethical practices. This includes ensuring transparent operations and safeguarding client funds.

- Dispute Resolution: Regulatory bodies often provide mechanisms for resolving disputes between traders and brokers, giving traders an additional layer of safety.

- Market Integrity: Licensing helps maintain the integrity of the financial markets by ensuring brokers conduct their businesses legally and ethically.

Who Regulates Pocket Option?

Pocket Option is owned by Gembell Limited, which operates under the regulations of the International Financial Market Relations Regulation Center (IFMRRC). This regulatory body is focused on providing oversight in the realm of online trading and helps in maintaining a secure trading environment. Although the IFMRRC is not as widely recognized as some other regulatory bodies, it does play a significant role in ensuring ethical practices among its members.

What Does the Pocket Option License Mean for Traders?

Having a license means that Pocket Option is committed to operating within a legal framework that prioritizes the safety and interests of its clients. Here’s what it means for traders:

- Financial Security: Licensed brokers typically maintain a separation of client funds and their operational funds. This means that even in a worst-case scenario, traders’ funds are safeguarded.

- Credibility: A license adds to the credibility of Pocket Option, allowing traders to trust that they are dealing with a reputable and compliant organization.

- Access to Resources: Licensed brokers often provide traders with access to educational resources, customer support, and analytical tools that can significantly enhance the trading experience.

Trading Conditions on Pocket Option

Aside from licensing, traders should also be aware of the trading conditions provided by the broker. Pocket Option offers several advantages, including:

- Low Minimum Deposit: Traders can start with a minimum deposit of just $50.

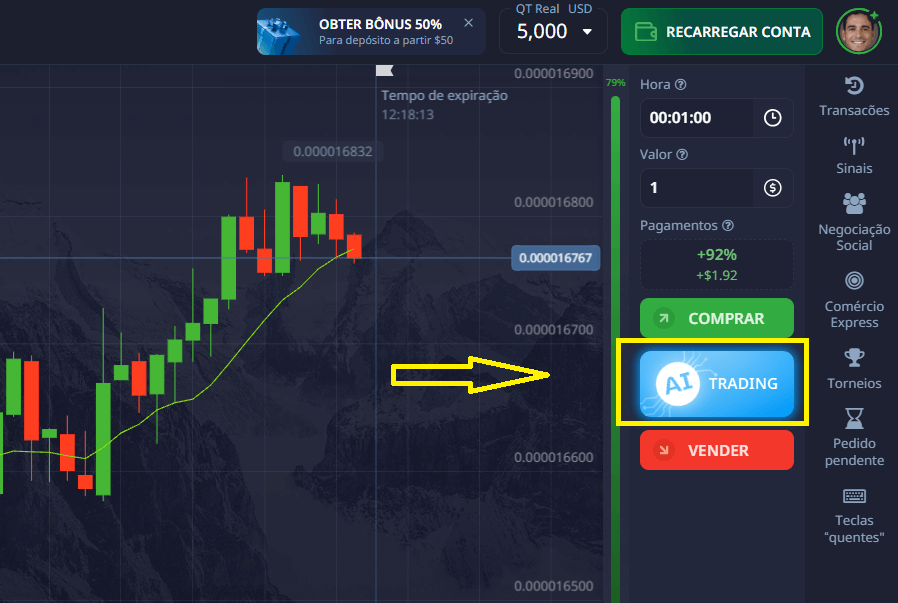

- High Returns: Traders can achieve returns of up to 92% on successful trades.

- Diverse Asset Selection: The platform supports trading in a wide variety of assets, including over 100 different financial instruments.

- Transparent Fees: Pocket Option’s fee structure is straightforward, with no hidden fees that might surprise traders later.

How to Ensure Safe Trading with Pocket Option

While Pocket Option provides a regulated environment, traders can also take personal steps to ensure their safety. Here are a few tips:

- Verify Regulatory Status: Regularly check the status of Pocket Option’s licenses and any updates from regulatory bodies.

- Read Reviews: Look for independent reviews and testimonials from other traders to get a sense of the broker’s reputation.

- Use a Demo Account: Before investing real money, try utilizing the demo account feature to become familiar with the platform.

- Practice Risk Management: Always be aware of the risks involved in trading and employ risk management strategies to protect your capital.

The Future of Online Trading and Licensing

As technology evolves, so does the landscape of online trading. The importance of licensing will continue to grow, particularly as more people engage in trading from their homes. Regulations may become stricter, ensuring that only the most reliable brokers are allowed to operate. For traders, staying informed about licensing matters will be crucial to navigating the changing trading environment.

Conclusion

Understanding the licensing of Pocket Option is a vital step for any trader looking to ensure a safe and secure trading experience. While Pocket Option offers a range of features and trading opportunities, it’s critical to recognize the importance of operating within a regulated framework. Always verify the broker’s licensing and ensure that you are dealing with a credible institution. By doing so, you can engage in trading activities with confidence, knowing that your interests are protected.